According to SEAI, Ireland has a €3 billion investment potential in Energy Efficiency – which will deliver a Net Present Value (NPV) – net savings – of €8 billion1. This is equivalent to nearly a quarter of primary energy demand in 2013 (nearly 35 TWh) – more than what is needed to fulfil Ireland’s 2020 carbon targets. While at the moment, Ireland is off course to meeting its carbon reduction goals by 2020, there is enormous commercial opportunity for energy efficiency providers – and the time to tap into this market potential has never been better.

The question remains – how can you tap into this potential and get projects off the ground? Which contract types work best for which types of projects (ex: according to technology type, payback time, investment size), where is the finance coming from, and how are deals actually structured? When is higher cost, off-balance sheet finance better than on balance sheet debt?

The IGBC in partnership with Joule Asset Europe is delighted to invite you to a new three-webinar series looking at contract types, sources of finance and actual finance available.

WEBINAR 1: THE POWER OF ENERGY EFFICIENCY:

Energy efficiency finance – sources of innovative financing for energy efficiency: On-bill, on-tax, and crowd financing

AGENDA

On-bill and on-tax finance

- Business Perspective – Kristina Klimovich, Head of Marketing and Communications, GNE Finance

- Municipal case study – City of Olot, Spain

Crowd financing

- Business perspective – Benedetta Friso Bellemo, Joule Assets Europe

- Case study – Italy

If you are interesting by this webinar, please click on this link for free registration:

BOOK HERE: The power of energy efficiency: “Sources of innovative financing for energy efficiency: On-bill,on-tax and crowd financing”

WHO SHOULD ATTEND?

Energy service companies (ESCOs), engineers and consultants, development managers and sustainability professionals with an ambition to improve the process of project uptake in their own businesses or for their clients.

WHY ATTEND?

To be at the forefront of a fast-changing industry and gain insights into the current landscape for finance for energy efficiency other clean energy projects. This webinar series will provide an ideal platform to learn energy efficiency finance best practices and discuss the implementation of innovative solutions with your peers and experts.

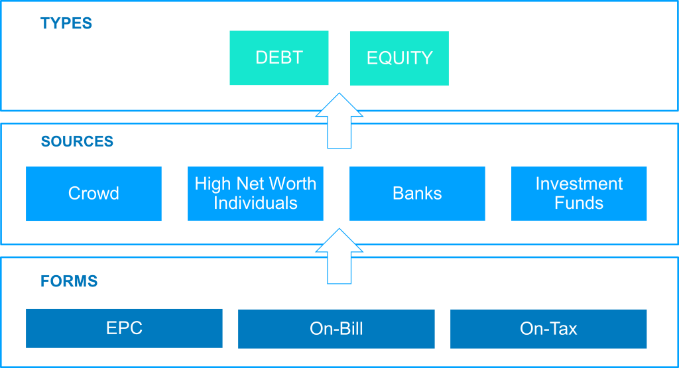

This series will look to demystify fear or scepticism project developers may have towards Energy Performance Contracting (EPC), define other innovative contracting and financing methods for clean energy projects, and look at the sources and types of finance for projects that are currently available, as well as investor requirements.

ABOUT JOULE ASSETS EUROPE

Since the SEAF H2020 project – the Sustainable Energy Asset Framework – which ran from 2016-2018, Joule Assets Europe has been working as an intermediary between project developers and financiers with the mission of enabling all viable clean energy projects to reach deal closure and completion. Our three-part webinar series, The Power of Energy Efficiency, will shine light on best practices for contractors of Energy Performance Contracting (EPC) projects and other innovative financing structures, what types of finance are currently available on the market today, and real investor requirements.