Green building policy and training in Ireland

Finance & Sustainable Investment

Here you can find learning materials on sustainable finance.

The content includes webinars, reading materials and other resources.related to sustainable finance. This will cover discounted green mortgages, green bonds and sustainable taxonomy. We will continually add materials as these come available so check back again soon if you cannot find what you want.

Home » Learning Hub » Finance and Sustainable Investment

Climate Related Risk

Sustainability and Commercial Real Estate

This briefing paper, Sustainability and Commercial Real Estate, is the result of a collaboration between the Irish Green Building Council and AIB, and it is the first in a series titled Sustainability, Finance and the Built Environment.

The purpose of this paper is to introduce key concepts to investors and developers, in the context of climate risk impacts on both the financial sector and the built environment.

Download now

A Framework for Measuring and Reporting of Climate-related Physical Risks to Built Assets

This Framework, developed by UKGBC, provides organisations with a consistent methodology for measuring climate-related physical risks to built assets. The guidance includes detailed information on the physical risk assessment process; a methodology for built asset scale; and a standalone reporting framework that can be used to support the preparation of TCFD disclosure reports.

Download

Carbon Risk Real Estate Monitor Tool

The CRREM Risk Assessment Tool to identify stranded assets is designed for asset owners and investors to understand the carbon risks inherent in their real estate portfolio. All EU member-states & UK commercial pathways are directly integrated into the tool. Nevertheless, the tool can also be used outside the EU and for residential properties.

Green Finance

Practical briefings on the EU taxonomy usability and webinar series #1: Taxonomy Usabilty

Helena Vines Fiestas, Spain’s National Security Market Commissions & EU-Platform co-Rapporteur of Usability & Data Workgroup

Sean Kidney, CEO at Climate Bonds

Watch now

Practical briefings on the EU taxonomy usability and webinar series #2: What it means for investors

Julia Backmann, EU Head of Business Legal, Allianz GI

Helena Vines Fiestas, Spain’s National Security Market Commissions & EU-Platform co-Rapporteur of Usability & Data Workgroup

Sean Kidney, CEO at Climate Bonds

Watch Now

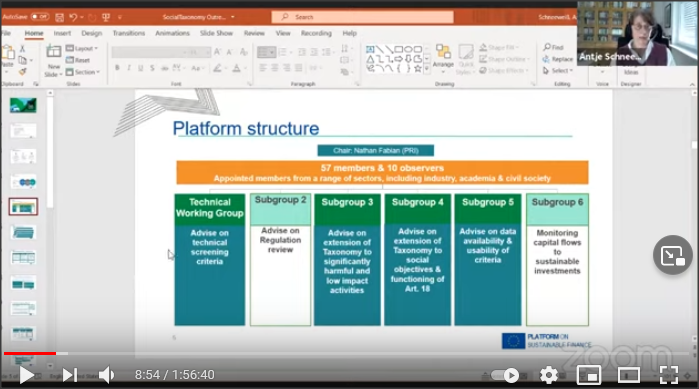

EU Platform presentation on proposed "Significantly Harmful" & "No Significant Impact" Taxonomies

Watch Now

Watch Now

NEW TAXONOMY AREAS: EU Platform presentation on proposed "Social" Taxonomy

Watch Now

Watch Now

Practical briefings on the EU taxonomy usability and webinar series #3: What it means for corporations

Isabelle Lambert, CSR Director at SPIE

Nadia Humphreys, Sustainable Finance at Bloomberg LP

Sean Kidney, CEO at Climate Bonds

Watch Now

The Economic Case for Nature

This event, held on 22 June 2021, presents New World Bank’s research which shows how biodiversity underpins economies, the health of communities and our planet more generally.

Watch Now

Better Home 2020 Conference

Green Finance – Green Homes

This conference looks at the imperative to fully decarbonise new home building across the full life cycle in order to meet the Paris Agreement. How can the finance sector help us get there? What impact will the new EU Taxonomy have? What will be the impact of Covid 19 on the design of homes?

Watch Now

BU Expert Talk with Ursula Hartenberger

[30 minutes] Expert in energy efficiency and finance in building sector talks about the dynamic nature of EU taxonomy, market acceptance and next steps (9 October 2020)

Watch Now

Banking essential webinar from European Banking Federation

[45 minutes] How is the banking sector preparing to adapt to the new context of European Green Deal (one trillion euro), Sustainability agenda and EU Economy? (15 September 2020)

Watch the video

EU Taxonomy & Green Finance Initiatives for Residential projects

[40 minutes] Sean Kidney introduces the EU taxonomy at a SMARTER webinar (9 July 2020)

Watch the video

Disclosure of Climate-Related Financial Risks

[12 minutes] Conversation with Michael Sheren, senior advisor at the Bank of England about shifting banking resources to sustainable investment (4 March 2020)

Listen Now

EU Taxonomy & Green Buildings

What is regarded as a Green Building under the EU Taxonomy and why does it matter? Read this presentation by Laura Heuston (SustainabilityWorks).

Read the pdf

Podcast: Green Lines

Minister of Finance Pierre Gramegna talks about Luxembourg’s successful efforts in the field of sustainable finance and looks at the priorities ahead. Launched by UN-convened International Network of Financial Centres for Sustainability (FC4S)

Listen Now

Panel discussion: Testing the application of the EU Taxonomy to core banking products – High level recommendations

The European Banking Federation (EBF) and UNEP FI co-organized this online event to launch a report: Testing the application of the EU Taxonomy to core banking products: High level recommendations.

Watch Now

What IGBC Does - Rating Green Buildings & Green Finance

The next phase of housing development in Ireland must consider sustainability principles. Discover how IGBC’s Home Performance Index can enable sustainable housing development and be the tool to unlock green finance.

Presenters: John Fingleton and Johanna Varghese

Members Non-MembersGreen Mortgages

Making a case for certified green homes

Making a case: Green Mortgages for Certified Green Homes

The aim of this presentation is to discuss the commercial benefits for amortgagelender of collaborating with us on an EU funded initiative that aims to drive change in the finance and green certification of new sustainable homes

Read the documentKey Reading Material

Final Report on Social Taxonomy (Platform on Sustainable Finance, February 2022) Decarbonizingconstruction Guidance for investors and developers to reduce embodied carbon (One Click LCA & WBCSD, July 2021) Draft report on social taxonomy : Extending the EU taxonomy to social objectives July 2021 The Economic Case For Nature (World Bank Group, 2021) Volume 1, issue 1 articles listing for Circular Economy and Sustainability (June, 2021) Overview and Recommendations for Sustainable Finance Taxonomies (ICMA, May 2021) A Guide to the Task Force on Climate related Financial Disclosures (TDFC, 2021) Financing Energy Efficiency in Ireland - A Handbook on the Residential Sector (SustainabilityWorks, 2021) Testing the application of the EU Taxonomy to core banking products – High level recommendations (UNEP, 2021) Climate Financial Risk Forum Guide (CFRF, June 2020) The Ripple Effect of EU Taxonomy for Sustainable Investments in U.S. Financial Sector (Kirkland & Ellis LLP, June 2020) Taxonomy: Final report of the technical Expert Group on Sustainable Finance (EU Technical Expert Group on Sustainable Finance, March 2020) Does energy efficiency predict mortgage performance? (Bank of England, 2020) Final report of the High-Level Expert Group on Sustainable Finance (European Commission, 2018) Creating and Energy Efficient Mortgage for Europe: Review of the impact of Energy Efficiency on probability of Default (SAFE and Goethe University, 2017) Location Efficiency and Mortgage Default (Rauterkus, Thrall and Hangen, 2010)